Do you know how Case Management AML software improves financial investigations? AML software is used to make the laundering process easier for investigators so they can organize, track and analyze suspicious activities in the fastest way possible. It makes complex tasks more efficient and allows them to file in on any potential red flags faster.

It aims to be simple and accurate, and AML software makes informed decisions possible through workflow automation and real-time case tracking. It minimizes the chance of error, so nothing is missed. Having the appropriate case management AML solution implemented, banks will be able to enhance their investigative efficiency and reinforce their compliance efforts.

What is Case Management Software?

Case management AML software is meant to assist financial establishments in tracking and managing AML investigations. The platform serves as a central hub for investigators to manage cases, track progress, and collaborate more efficiently.

The AML case management system allows institutions to organize their AML case management workflow with all information in one easy to access, updated platform. This software simplifies complex tasks of managing cases involving suspicious financial activity.

Bonus: Learn more about AML case management solutions that cater to advanced needs here.

Importance of AML in Finance

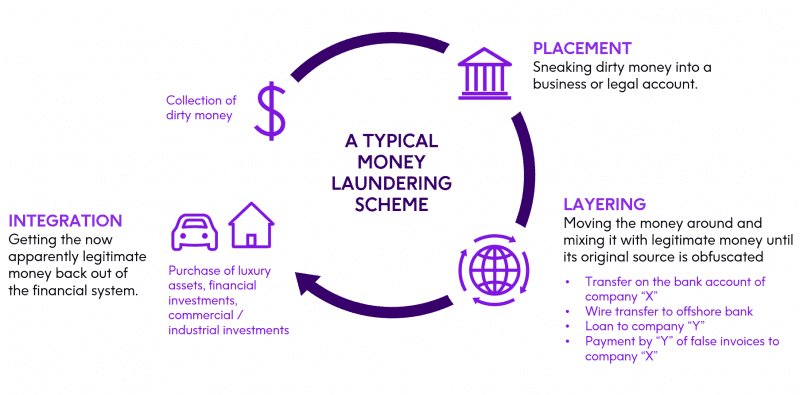

Money laundering and protecting the financial system is AML in finance. AML case management software in financial institutions typically monitors suspicious activities and validates that these do not occur to facilitate illegal transactions.

An AML investigation can assist in the recognition of patterns that are connected to money laundering. Financial institutions implement AML practices to avoid making large financial penalties, aiming to enforce their reputation and contribute to the strength of the entire financial sector.

Key Features of AML Software

AML case management software comes equipped with many features that help drive investigations and compliance. Some of the key features that they include are automated workflows, real time alerts, powerful reporting tools, etc.

An AML case management system enables investigators to prioritize cases, track actions taken, and document findings well. This increases the AML investigation’s speed and compliance with high quality. The software offers customizable dashboards for monitoring case status and enables smooth communication among team members.

Automated Case management tasks

When it comes to AML case management software, task automation is a revolution. It speeds up routine processes like case creation, updating, or task assignment. This helps whitespace manual work and ensures no things are missed out.

Automation of the AML case management workflow not only saves time but also allows financial institutions to concentrate on more important parts of the AML investigation.

Automated alerts and reminders ensure that deadlines are adhered to and pivotal milestones are not overlooked. This results in more efficient and effective AML operations, leading to enhanced compliance and fewer operational risks.

Improved Accuracy in Investigations

Accuracy is a crucial characteristic in any AML analysis, and an AML case management system is an effective solution to this issue as well. This structure helps investigators to follow the procedure, thus minimizing human error.

It monitors every detail, from suspicious activity to case resolution. AML case management helps investigators depend on accurate data, which aids in making better decisions and identifying potential risks easily.

Streamline Compliance Procedures

AML case management software can also help to streamline compliance processes. Financial institutions can readily monitor and document suspicious activities. It organizes everything so investigations are compliant with regulations.

An effective AML case management system provides reassurance in terms of compliance, reducing the risk of non-compliance on an ongoing basis.

Reduce Operational Risks

AML case management software also helps to mitigate some of these operational risks by automating many of the manual tasks involved. An AML case management system enables financial institutions to detect suspicious activities promptly and to work on such cases effectively.

Automating this process minimizes the risk of human error, a significant risk factor in conventional AML investigations. A consolidated AML case management workflow ensures investigators don’t overlook critical processes and are better at managing risks.

Improve Reporting and Documentation

Good reporting and clear documentation are crucial in AML investigations. With AML case management software, you can organize and store all the information you need in one spot.

The software automatically creates elaborate reports to track investigations and maintain compliance with relevant regulations. The AML case management system ensures that no important information is missed in the inquiry by enhancing reporting procedures.

Flexibility and Integration with Other Systems

This AML case management system takes a seamless approach to integrating with other financial systems. It enables the seamless transfer of data, which accelerates the AML case management process. That also helps to make sure all relevant information gets captured and utilized in investigations.

By working in conjunction with other systems, the AML case management software makes it easier for investigators to assess if they are making better decisions early in the investigation process while optimizing the time taken in the financial investigation.

Integrating AML case management software is vital for ensuring financial investigations are carried out efficiently and accurately. This is a critical tool in keeping compliant and managing risks appropriately. Find out how AML case management software can simplify financial compliance processes.